That editorial suggests that the projected slow down in securities class action filings in 2006 is related to the current legal woes surrounding famed class action powerhouse Milberg Weiss Bershad & Schulman LLP.

The author of this humble blog has his own opinions on the decline in federal securities class actions.

First, the number of federal securities class actions has potentially slowed because a substantial portion of the plaintiffs bar is busy filing other types of securities cases, including state and federal derivative actions.

A review of law firm websites, such as Gardy & Notis, LLP and Schiffrin & Barroway LLP bears out the numbers suggested by The D&O Diary's options backdating litigation tally - but the overwhelming majority of those cases have been filed as derivative actions.

Other firms, such as Lerach Coughlin Stoia Geller Rudman & Robbins LLP have been described as filing dozens of options backdating suits, but a review of the Lerach Coughlin website does not shed much light on the cases that the firm has filed.

Second, as regular readers of this blog have discerned (see prior posts here, here, and here for example) there have been a substantial number of state breach of fiduciary duty claims filed in recent months, many relating to proposed mergers or other corporate transactions.

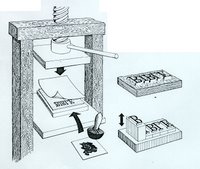

Both of these "reasons" for the drop-off in federal securities class action filings might safely be lumped together under the "printing press" theory.

Both of these "reasons" for the drop-off in federal securities class action filings might safely be lumped together under the "printing press" theory.As suggested by MoFo's Jordan Eth in this National Law Journal article from last year, the "speed of Bill Lerach's printing press" may be a limiting factor in the number of securities lawsuits filed each year.

If the collective "printing press" of the plaintiff's bar is largely filled with derivative options backdating cases and state law breach of fiduciary duty cases, then the total number of federal cases will likely decline.

Of course, as noted by The D&O Diary here, the plaintiff's securities bar is expanding with firms that had historical backgrounds in asbestos and tobacco litigation, such as Motley Rice LLC and Kahn Gauthier Swick, LLC, joining the fray, so the output capacity of the presses may still be increasing.

No comments:

Post a Comment